Hard Money Georgia Fundamentals Explained

Table of ContentsHard Money Georgia - QuestionsThe Single Strategy To Use For Hard Money GeorgiaOur Hard Money Georgia DiariesThe 25-Second Trick For Hard Money GeorgiaHard Money Georgia Things To Know Before You BuyThe Ultimate Guide To Hard Money Georgia

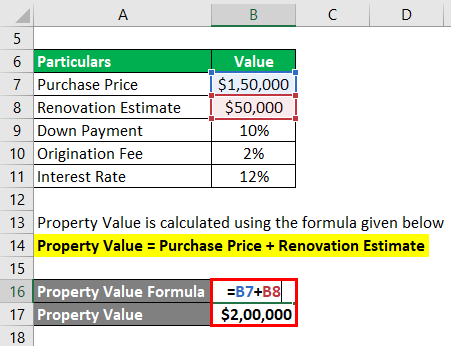

Considering that hard money financings are collateral based, likewise called asset-based finances, they need marginal paperwork and also enable capitalists to shut in a matter of days - hard money georgia. These car loans come with more risk to the loan provider, as well as therefore require greater down repayments as well as have greater rate of interest prices than a standard financing.Several standard financings might take one to two months to close, however hard money fundings can be closed in a few days.

Many tough cash car loans have short settlement periods, normally between 1-3 years. Traditional home loans, in contrast, have 15 or 30-year repayment terms generally. Difficult money loans have high-interest rates. A lot of difficult cash car loan passion prices are anywhere in between 9% to 15%, which is considerably more than the rates of interest you can anticipate for a conventional home loan.

The Facts About Hard Money Georgia Uncovered

This will certainly include buying an evaluation. You'll receive a term sheet that lays out the funding terms you have actually been authorized for. When the term sheet is signed, the funding will be sent out to processing. During financing handling, the lender will certainly ask for records as well as prepare the financing for last lending testimonial and also schedule the closing.

:max_bytes(150000):strip_icc()/hard-money-basics-315413_Final-cdfb8155170c4becb112da91bd673fe8-0472b1f57ff94abebddef246c221a65f.jpg)

Getting My Hard Money Georgia To Work

Usual leave approaches consist of: Refinancing Sale of the property Payout from other source There are lots of circumstances where it might be advantageous to make use of a difficult cash funding. For beginners, real estate investors who such as to house turn that is, buy a rundown residence in demand of a lot of work, do the work personally or with professionals to make it better, then reverse as well as sell it for a higher price than they purchased for might find hard cash finances to be excellent financing choices.

Since of this, you can look here specialist house fins normally like short-term, busy funding solutions. Home fins typically try to market homes within less than a year of buying them. As a result of this, they don't require a long term and also can prevent paying as well much interest. If you purchase investment properties, such as rental residential properties, you might likewise find tough cash loans to be excellent options.

Sometimes, you can anchor additionally use a difficult money finance to acquire uninhabited land. This is a good alternative for developers who are in the process of receiving a building and construction lending. Note that, also in the above circumstances, the potential disadvantages of hard money financings still use. You need to make certain you can settle a difficult cash car loan before taking it out.

How Hard Money Georgia can Save You Time, Stress, and Money.

While these kinds of fundings might appear hard and also intimidating, they are a generally made use of funding approach several genuine estate financiers use. What are hard cash car loans, and also exactly how do they work?

Difficult money finances typically come with higher passion prices and also much shorter payment routines. Why select a hard cash funding over a conventional one?

A tough money lending may be a feasible choice if you are interested in a fixer-upper that might not certify for conventional funding. You can additionally use your existing realty holdings as collateral on a hard money financing. Tough money lending institutions typically lower threat by charging higher passion prices and also offering much shorter repayment timetables.

More About Hard Money Georgia

Furthermore, because private people or non-institutional loan providers provide difficult cash financings, they are exempt to the very same regulations as standard loan providers, which make them much more risky for customers. Whether a hard cash funding is best for you depends on your situation. Difficult money financings are good alternatives if you were denied a conventional funding as well as need non-traditional financing.

Contact the expert home mortgage advisors at Right Begin Home Loan for additional information. Whether you desire to acquire or re-finance your house, we're right here to aid. Obtain started today! Ask for a totally free personalized price quote.

The application procedure will generally entail an evaluation of the building's value and also potential. This way, if you can't manage your payments, the hard cash loan provider will just relocate ahead with selling the home to redeem its financial investment. Difficult money loan providers typically charge greater rate of interest than you would certainly carry a standard financing, yet they additionally money their loans faster and usually call for much less documents.

Little Known Questions About Hard Money Georgia.

Rather than having 15 to thirty years to settle the funding, you'll typically have simply one great post to read to 5 years. Difficult cash financings function rather in a different way than standard finances so it is essential to understand their terms and what purchases they can be used for. Tough cash finances are normally meant for investment buildings.